Social Security’s 2025 COLA: What Beneficiaries Can Expect

Share

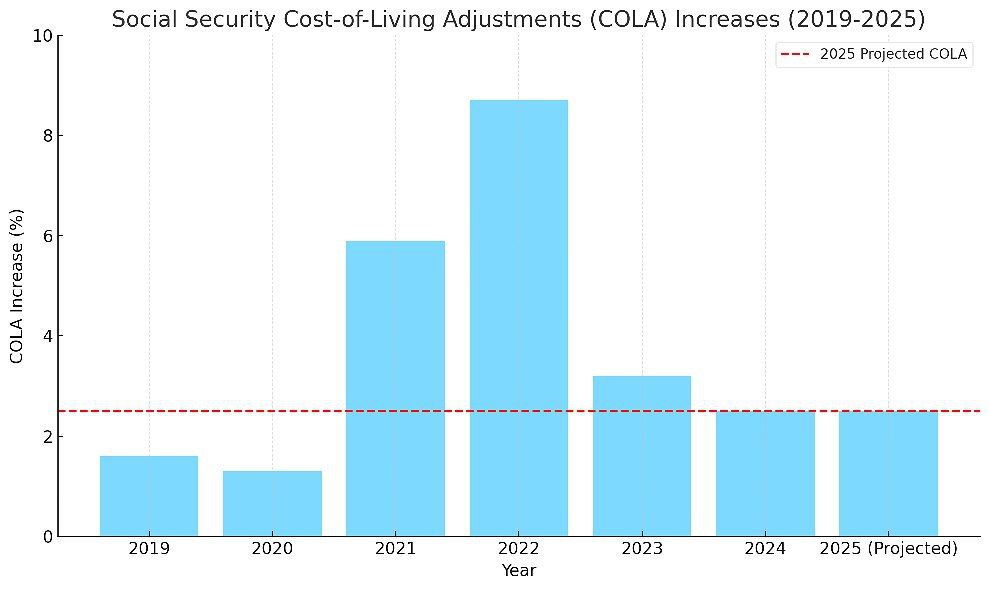

The 2025 Cost-of-Living Adjustment (COLA) for Social Security is projected to be around 2.5%, reflecting a significant decrease from the previous years. This forecast comes amidst a broader economic trend of declining inflation rates, which is favorable for consumers but may limit the financial relief for retirees relying on Social Security benefits.

Mark Your Calendars: Anticipating the 2025 Social Security COLA and Its Crucial Role for Retirees

The annual announcement of the cost-of-living adjustment (COLA) is the most anticipated event for Social Security’s over 68 million beneficiaries. Most retirees rely on their monthly Social Security checks to cover essential expenses. In fact, Gallup’s annual surveys over the past two decades show that 88% of retirees view Social Security as a “major” or “minor” income source, with only 11% saying it is unnecessary. This highlights the vital role Social Security plays in providing financial stability for many Americans.

In just 11 days—mark October 10 on your calendar—the Social Security Administration will unveil the COLA for 2025. Recent forecasts suggest a projected increase of around 2.5%, reflecting a consensus among analysts regarding the expected size of this adjustment. This figure marks a significant decline from the previous year, where the adjustment was as high as 8.7%.

Understanding the Purpose of COLA

Before digging into how much Social Security benefits are set to climb in 2025, it’s crucial to understand the purpose of the COLA. In an ideal world, prices for goods and services would remain constant, alleviating concerns about Social Security income losing purchasing power. However, in reality, the cost of living fluctuates, often increasing.

The COLA is designed to ensure that beneficiaries do not lose purchasing power due to inflation. From the first mailed retired-worker check in January 1940 through December 1974, there wasn’t a systematic way to assign COLAs. Instead, Congress passed arbitrary increases at various times. Notably, in 1950, a record-breaking 77% COLA was enacted.

Since 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has been used to calculate annual COLAs. The CPI-W tracks price changes in over 200 goods and services, allowing for straightforward month-to-month and year-over-year comparisons.

Only the trailing 12-month readings during the third quarter (July through September) contribute to the COLA calculation. If the average CPI-W reading in Q3 of the current year exceeds that of the same period last year, it indicates collective price increases, resulting in benefit adjustments the following year.

Historical Context of COLA Increases

Here’s a summary of the COLA increases from 2019 to 2025:

| Year | COLA Increase (%) |

|---|---|

| 2019 | 1.6 |

| 2020 | 1.3 |

| 2021 | 5.9 |

| 2022 | 8.7 |

| 2023 | 3.2 |

| 2024 | 2.5 (Projected) |

The projected 2.5% increase for 2025 emphasizes a return to more typical COLA rates after the exceptional adjustments seen in previous years. The 2025 projection also reflects the broader economic trend of declining inflation rates, which may provide some relief for consumers but limits the financial boost for retirees.

Implications for Retirees

The anticipated COLA increase is vital for many retirees aiming to maintain their standard of living. However, a modest increase like 2.5% may not be enough to offset rising costs, especially in healthcare. Medicare premiums and other essential expenses may continue to rise, thereby diminishing the actual benefit of this adjustment(Money Digest)(24/7 Wall St.).

As the October 10 announcement approaches, beneficiaries will be watching closely for updates on the COLA. Understanding the rationale behind these adjustments and their implications is essential for navigating the financial landscape in retirement. The COLA serves not just as a numerical increase in benefits but as a critical component of financial security for millions of Americans.—